-

Tax Headaches

address:1009 6 Street SW Calgary, Alberta T2R 1H3,

Calgary AB, T2R 1H3tel:403-818-1071fax:website:employees: -

Update BusinessContact this Business

Update BusinessContact this Business

-

BUSINESS LOCATION

A -

TAX HEADACHES CUSTOMERS REVIEWS

There are currently no reviews yet. Be the first one to write a review!-

RELATED BUSINESSES BY LOCATION

-

BUSINESS CATEGORY

BUSINESS DESCRIPTION

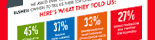

We’re the Tax Headaches team, your trusted partner in navigating the complexities of Canada Revenue Agency (CRA) representation for business owners facing challenges with the Canada Emergency Response Benefit (CERB) and tax-related issues. We understand the stress and uncertainty that can accompany dealings with the CRA, especially in the ever-evolving landscape of government support programs and tax regulations. With our expertise and dedication, we are committed to providing personalized guidance and strategic solutions to help you achieve compliance, resolve disputes, and safeguard your financial interests. Whether you’re seeking assistance with CERB eligibility, tax audits, or proactive tax planning, our team of experienced professionals is here to support you every step of the way.FIND JOBS IN CANADA

-